The administration of the buying and selling platform and its elements requires several software program sources, servers, and protocols, making it inconceivable to connect such a platform to the business’ infrastructure. Turnkey solutions also provide businesses with a reliable infrastructure and backup methods to maintain operational resilience, which is essential when dealing with technical glitches or market volatility. It is also Turnkey Forex Solutions crucial that these solutions come outfitted with built-in safety safeguards as well as meet international anti-money laundering laws to keep away from incurring fines or penalties from regulators.

Foreign Exchange turnkey solutions could be helpful for anybody trying to begin or scale a brokerage enterprise, including entrepreneurs, monetary institutions, and current companies looking to expand their offerings. The Forex system prepared for use includes a number of components, corresponding to White-label platforms, social trading platforms, a framework for managing risk, and automated buying and selling techniques (ATS). Utilising these elements makes it potential to quickly set up a web-based Forex brokerage service without starting from scratch.

Challenges And Risks Associated With Turnkey Solutions

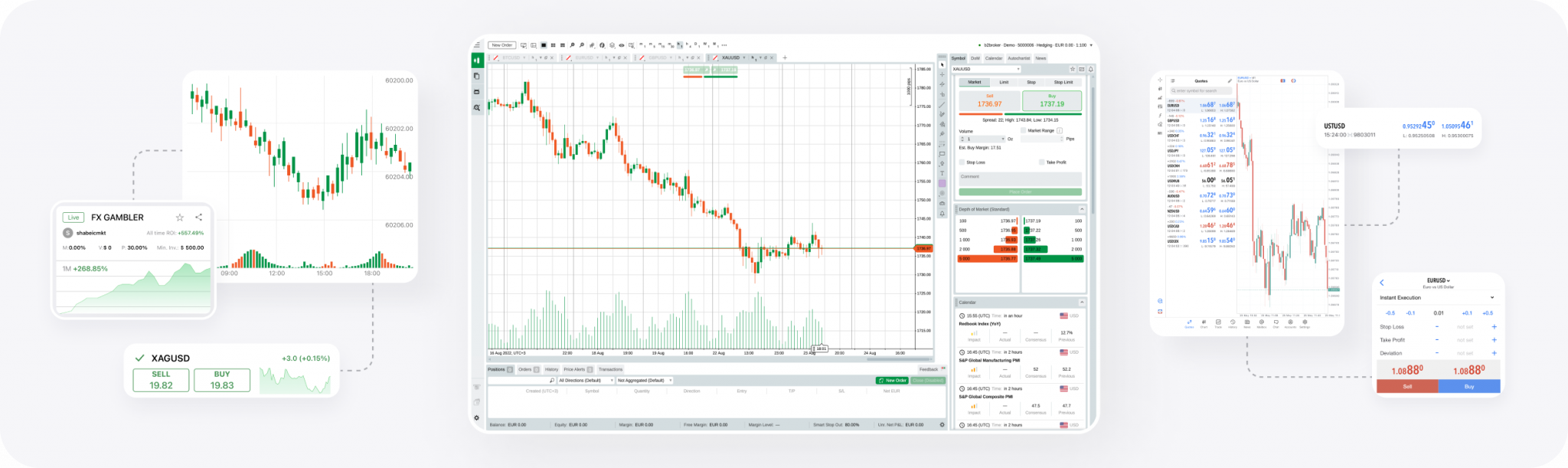

It needs to be dependable, intuitive, and full of the features merchants count on, whether or not they commerce manually or use automated systems. Platforms like cTrader and MT5 are popular for a purpose, and a few suppliers also provide robust proprietary options (for instance, B2TRADER). Turnkey options have become more common lately, notably in the retail brokerage space. However, ready-made infrastructure for liquidity providers has been limited.

- In today’s ultra-competitive foreign exchange market, launching a brokerage from scratch has turn out to be a complex, capital-intensive endeavor.

- Integral’s expertise guarantees ultra-low latency execution, smart order routing, and complete market analytics.

- Launching a brokerage often entails setting up an organization in a favorable jurisdiction.

- Deliver a standout brand to your shoppers with totally customizable platforms and seamless integrations.

- Forward-thinking Foreign Exchange platforms are actively integrating crypto buying and selling solutions to satisfy this demand and bridge the traditional-digital divide.

- You will be ready to manage all elements of your trading & foreign exchange services from one place with our high-performance, automated CRM.

The Rise Of Social And Copy Trading

The firm leverages machine learning and AI to reinforce pricing fashions and commerce execution. Our partnership with Rotex has been invaluable in refining and expanding our CRM options. With their support, we’ve been in a place to deliver smarter, more effective tools that empower Forex brokers to manage their operations seamlessly. Rotex reliability and innovation have been key in fostering belief and driving mutual success. Our dedicated forex back office help professionals present skilled help with all of your administrative, operational, and compliance needs, allowing you to give consideration to strategic development initiatives. 4- Threat Administration Technique for setup of Abook, Bbook, Cbook on Trading platform & liquidity Bridge Levels, also computerized danger management Tools recommendations & Setups.

An all-in-one Foreign Exchange system has been designed for a fast and hassle-free setup process. This system could be up and operating in only a few days, as opposed to the weeks and even months it takes for different methods. However, Android-based smartphone users can download the APK file immediately from the B2BROKER interface. This eliminates the necessity to log in to your Google account and directly set up the app on your system. The app is instantly obtainable on the App Retailer for iPhone and other iOS-based devices, while the Android version remains to be under growth and shall be released quickly on the Google Play Retailer. Our cellular app allows you to handle all your business aspects from one place, anyplace, anytime.

Spot Algo Trading: Strategies, Platforms & Automation

The selection of the proper supplier determines whether or not your forex brokerage succeeds or struggles with technical issues. The second is established companies trying to add companies to their merchandise. Both groups avoid pointless technical muddle and might give attention to what’s essential to their clients and enterprise. Finally, embracing a strong turnkey forex trading resolution accelerates your journey to market success, providing a solid basis for delivering distinctive buying and selling experiences today and properly into the longer term.

For anybody coming into or increasing within the forex trading enviornment, selecting the best turnkey solution is instrumental in establishing a stable, aggressive, and worthwhile operation. These comprehensive platforms eliminate many technical and logistical hurdles, permitting entrepreneurs to focus on enterprise development and consumer engagement. Look for pre-configured compliance packages for main regulators (CySEC, FCA, ASIC, FSC Mauritius) and offshore jurisdictions. Essential features embrace automated regulatory reporting for MiFID II/EMIR/FATCA, built-in surveillance instruments, comprehensive document administration systems, and jurisdiction-specific customization choices.